overview

Retail with Infinite Paperless Suite

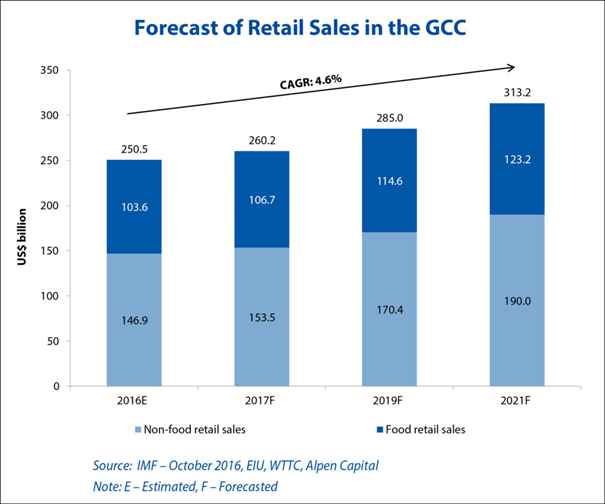

Despite macro-economic headwinds and a slowing global economy, the GCC’s retail sector is forecast to grow by about 22 per cent to $308 billion in 2023 from last year with the UAE and Saudi Arabia accounting for the bulk of sales over the next five years.

The size of the Arabian Gulf retail sector market is expected to see 4 per cent compound annual growth rate until 2023, rising from $253.2bn recorded in 2018, Dubai-headquartered investment advisory firm Alpen Capital said in its latest GCC Retail Industry report. Saudi Arabia and the UAE, the two largest economies in the Arab world, account for about 77 per cent of sales in the next five years.

Population growth, a rise in per capita gross domestic product, and an expanding tourism industry will help drive the retail sector’s acceleration and boost economic diversification efforts of traditionally hydrocarbon-dependent GCC countries, according to the report.

“Demographics are favourable for the growth of retail sector [with the population] rising faster than some of the other parts of the world,”

– said Krishna Dhanak, executive director at Alpen Capital.

The retail sector across the Arabian Gulf states, has been under pressure in the past few quarters due to a slowdown in the global economy, lower oil prices and muted demand. However, developers have continued to build mixed-use projects with retail components, adding more capacity to the market.

Oil prices, which fell below $30 per barrel in the first quarter of 2016 have since recovered to hover around $70 per barrel and the economic momentum has gathered pace in the UAE. A boost in tourism numbers has also set the foundations for the retail sector’s growth and the economic recovery is expected to buoy consumer confidence.

Challenge

Retail challenges

- increase in Competition (Major international brands vying for space in catchment areas, limited quality retail space, Growth of homegrown brands – further fragmentation of the market),

- paper-based document flow,

- risk of COVID infections,

- non-automated proces,

- low visibility into the proces,

- lossing comptetive advantage,

- poor customer service,

- ineffective operations,

- expensive operations,

- Reluctance to full-fledged digital transformation,

- Skills Gap in the emerging technologies.